Governance and Oversight

Board Oversight of Climate and Other Risks

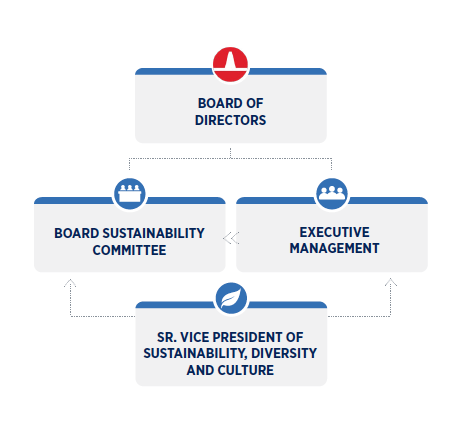

There are two Board committees responsible for oversight of sustainability issues and climate-related risks and opportunities.

The Sustainability Committee oversees sustainability risks and opportunities, including climate-change related matters, as well as the sustainability report and other sustainability-related disclosures, sustainability-related strategy, policies and practices, health, safety and environmental protection policies and related risks, human and workplace rights and policies, including diversity and inclusion policies and human capital management.

The Nominating and Corporate Governance Committee of the Board maintains oversight of governancerelated sustainability issues. All of the members of both committees are independent directors. The Sustainability Committee Chair communicates regularly with management regarding our sustainability progress and performance, including quarterly updates on assessments of our sustainability performance.

In addition, the full Board communicates regularly with management as part of its oversight of risk management for the Company, including the oversight of material risks, including transition risks relating to climate change and sustainability performance. Examples of climate-related risks that management discusses with the Board include, among other things, evolving market demand for loweremission services and technology, capital investment decisions relating to the development of lower-emissions technology and the purchase of lower-emissions equipment, strategic decisions relating to climate risk, including current and forecasted macroeconomic responses to climate change risk, investor feedback on climate risks and our sustainability practices, and policy

These types of risks are discussed by the Board and management at the regularly quarterly Board meetings, and also between regular meetings outside of the formal Board meeting context.

The Board also reviews communications from, and engages with, shareholders and other stakeholders in response to their climate-related and other inquiries. Directors keep up to date on the latest trends and information relating to climate-related risks, including through continuing director eduation courses. The Board routinely addresses matters relating to corporate responsibility, governance and sustainability at Board and committee meetings.

Other Board Committees

Our Audit Committee oversees management’s execution of Patterson-UTI’s accounting and financial reporting process, including review of the financial reports and other financial information provided by Patterson-UTI to the public and government and regulatory bodies, Patterson-UTI’s system of internal accounting, Patterson-UTI’s financial controls, and the annual independent audit of Patterson-UTI’s financial statements and internal control over financial reporting. The Audit Committee also oversees compliance with Patterson-UTI’s codes of conduct and ethics, compliance with legal and regulatory requirements (such as SEC disclosures in SEC reports and financial statements), and cybersecurity risk.

Among other things, our Compensation Committee sets and administers the policies that govern the compensation of executive officers of Patterson-UTI and meets on a regular basis to consider executive compensation matters and to review how Patterson-UTI’s plans and policies work in practice.

The Patterson-UTI Board of Directors met 11 times in 2023.

Reporting Structure For Climate Related Risks

The Compensation Committee considers sustainabilityrelated matters in determining executive compensation. Since 2017, a percentage of the payout under our executives’ cash incentive plan has been linked to the Company’s performance against targets on a Health, Safety and Environment key performance indicator (KPI). This Health, Safety and Environment KPI includes, among other things, targets for safety and environmental performance, as the Compensation Committee views these topics as crucial to the well-being of the Company’s employees and to the Company’s risk management. The 2023 Health, Safety and Environment KPI included metrics related to safety incident rates, environmental incidents, audits and training.

In addition to its role as one of our governing bodies, the Nominating and Corporate Governance Committee, among other things, identifies individuals qualified to become Board members, recommends for selection by the Board director nominees for the annual meetings of stockholders, recommends nominees for Board committee composition, reviews Patterson-UTI’s Code of Business Conduct and Corporate Governance Guidelines, develops and continually makes recommendations with respect to the best corporate governance principles and oversees the annual review of the Board and management and executive succession planning.

In addition to its role as one of our governing bodies, the Nominating and Corporate Governance Committee, among other things, identifies individuals qualified to become Board members, recommends for selection by the Board director nominees for the annual meetings of stockholders, recommends nominees for Board committee composition, reviews Patterson-UTI’s Code of Business Conduct and Corporate Governance Guidelines, develops and continually makes recommendations with respect to the best corporate governance principles and oversees the annual review of the Board and management and executive succession planning.

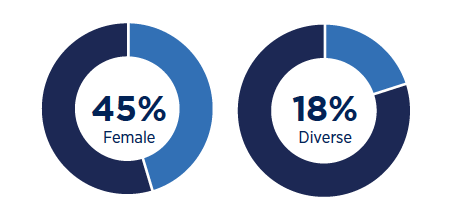

The Patterson-UTI Board is 45% female and 18% racially diverse.

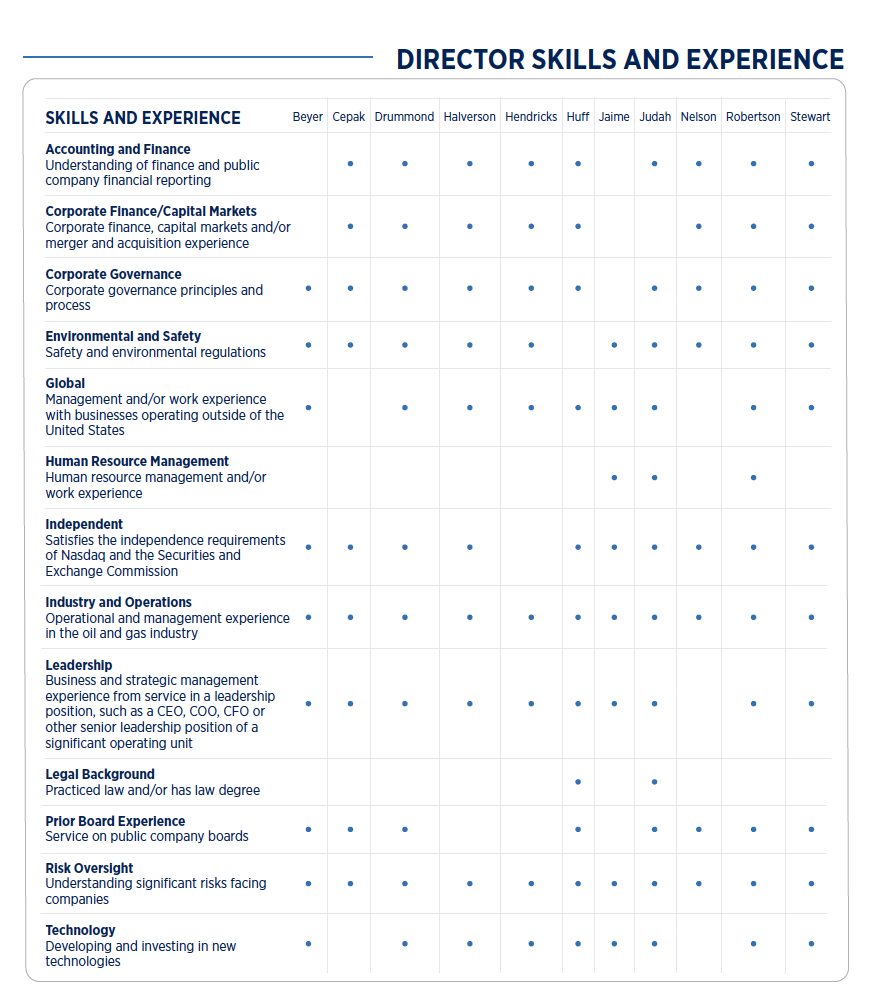

Each of these committees is comprised entirely of independent directors. As part of the director nomination process, our Nominating and Corporate Governance Committee, in evaluating a candidate for nomination to be a director, considers, among other things, diversity in professional background, experience, expertise and perspective (including age, gender and ethnicity). The composition of our Board of Directors is 45% female and 18% racially diverse. The Board’s diversity is reflective of its commitment to promoting a diverse and inclusive work environment for all.

Management’s Role in Risk Assessment and Management

Our senior-level management is responsible for identifying corporate risks, including climate-related risks and opportunities, assessing the potential level of impact to the business, and discussing this risk assessment with the Board on at least a quarterly basis. We believe that climate risks are inherently business risks, and our assessment of these climate-related transition and physical risks is integrated into our business risk assessment process.

Risks and opportunities are identified through discussions with stakeholders, including customers, investors, trade associations and industry groups; engagement with sustainability-related groups; and our own business risk assessments, as well as regular monitoring of legal, regulatory and policy changes with the potential to affect the industry as well as our Company specifically.

Our senior management and representatives from our business units regularly communicate with the Board on risk management matters. For example, the Board and senior management regularly discuss safety matters, sustainability issues, climate-related risks, information security risks and other risks that are important to our business. The key environmental and climate-change risks identified and monitored through our most recent risk mapping process were (i) Policy and Legal Risks, (ii) Market/Technology Risks, (iii) Reputational Risks, and (iv) Physical Risks. These climate-related transition and physical risks are discussed in more detail in “Climate-Related Risks and Opportunities” below.

Management of Sustainability Matters

Senior Vice President of Sustainability, Diversity and Culture

We continue to evaluate and evolve our Company in matters regarding sustainability, and recently expanded the role of our former Vice President of Diversity and ESG to a Senior Vice President of Sustainability, Diversity and Culture. This position continues to report directly to the CEO. Pursuant to the direction of the CEO and other members of the leadership team, and under the oversight of the Sustainability Committee of the Board, the Senior Vice President of Sustainability, Diversity and Culture provides direction and pursues a consistent approach across the business segments to sustainability-related initiatives and objectives.

The Senior Vice President of Sustainability, Diversity and Culture routinely meets with the Company’s leaders and other employees, including from the marketing and sales, technology, health, safety and environment, investor relations, legal, and operations departments to discuss the development and implementation of the Company’s sustainability initiatives, evaluate internal and external sustainability-related communications, and formulate advice, counsel and recommendations to senior leadership regarding sustainability efforts at the Company, including efforts around employee and community engagement.

The Senior Vice President of Sustainability, Diversity and Culture and other members of leadership routinely engage with the members of the Sustainability Committee of the Board to provide updates around sustainability-related policies and performance, including but not limited to, environmental risks and opportunities, social responsibility and impacts, employee, contractor and community health and safety, and activities related to stakeholder engagement and community investment.

Information Security and Cybersecurity Risks

We have implemented and maintain a cybersecurity program that is aligned with the National Institute of Standards and Technology (NIST) Framework and reasonably designed to protect our information and to assess, identify, and manage risks from cybersecurity threats that may result in material adverse effects on the confidentiality, integrity, and availability of our information systems.

The Company also monitors systems and practices regarding the use of artificial intelligence to enhance business objectives but also to ensure proper governance and oversight. These efforts are led by the Senior Vice President of Information Technology with input from key stakeholders across the business.

Our Audit Committee is responsible for overseeing information security and cybersecurity risk. Senior leadership communicates with the Audit Committee at least quarterly regarding information security risk and formally reports to the entire Board on information security risk at least annually. We continue to improve our cybersecurity practices through industry standard security frameworks and leading practices, including risk assessments/remediations, software and services, continuous systems monitoring, incident response plans, phishing simulations, employee training and communication programs, among other measures.

We have a robust information security training program through which all employees with a company-issued email receive annual cyber awareness training. In addition, at least annually, the Company performs monthly phishing simulations, with remediation training required as necessary.

Our net expenses incurred from information security breaches over the last three years, relative to total revenue, were immaterial, and we had zero net expenses incurred from information security breach penalties and settlements over the last three years.